Keyword Search: Steal Their YouTube Traffic Without Them Knowing!

Peek behind the curtain on YouTube and see exactly which keywords and videos are making your competitors money. You’ll spot the tags they rank for, how their launches are trending, and where the easy wins are, so you can skip the guesswork. Grab it here, copy what works, and grow faster starting today.

Friend to friend: a few links are affiliate links. When you purchase, I might get a tiny thank-you from the company, with zero added cost to you. I only recommend things that I’ve actually tried and looked into. Nothing here is financial advice; it is for entertainment. Read the full affiliate disclosure and privacy policy.

See rivals’ YouTube ads in under 10 minutes using a $0 tool: Google’s Ads Transparency Center. Add one dashboard to scale. Copy only what you can verify.

For scale, layer recent performance ranges so you judge what “good” looks like before copying ideas.

Fresh 2025 benchmarks place average YouTube view rate near ~32% across aggregated sources, while quarterly reports show seasonal peaks and shifting costs by format.

Treat these as guardrails, not guarantees, and always date any number you cite.

This mindset keeps your teardown focused and your expectations realistic as you move from curiosity to action—spot patterns, shortlist winners, and validate every standout ad back in the Transparency Center before you model it. – Wordstream

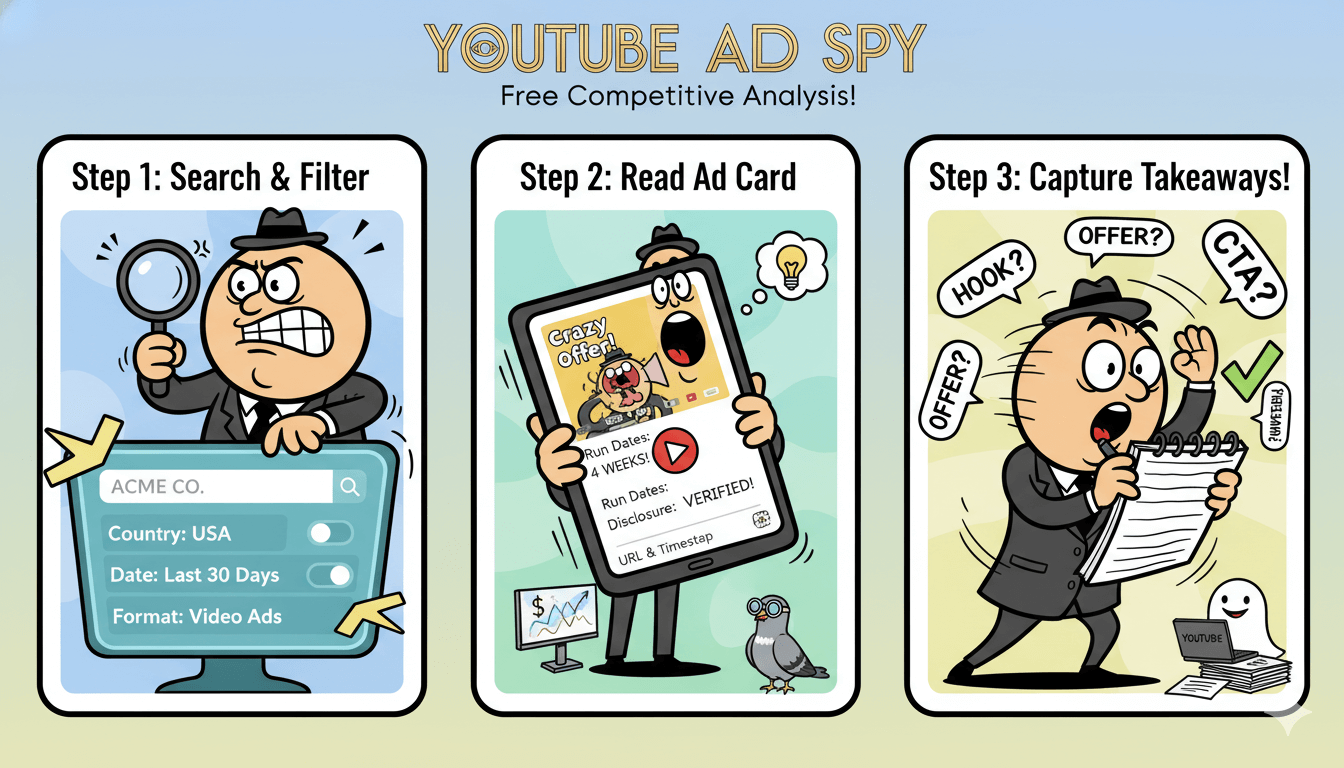

The free baseline: Google Ads Transparency Center

See any brand’s YouTube ads free in minutes. Filter by country and date, then open the ad cards you care about. You’ll get a clean snapshot of creative, run dates, and disclosures that tie to verified identity.

This matters because verified advertisers show public fields like names and locations, and Google notes that ad creatives plus served dates and locations can be exposed in transparency views.

Treat what you find as a baseline swipe file. Log hooks, offers, CTAs, and note how long each creative ran. Longer run windows often indicate durable performance, which helps you prioritize what to study first.

Access and filters that matter

Go to the portal and search by advertiser or website. Apply Date and Targeted location filters to narrow results. Use Ad format to isolate Video placements so you’re evaluating YouTube creatives rather than Search or Display.

This keeps your scan focused and comparable across brands.

Read an ad card: creative, dates, disclosures

Click any result to open the ad card. Note the video creative, the periods it served, and any disclosure elements. Google’s verification and disclosure policies explain why these fields exist and how identities are shown across Google services, including YouTube.

Capture the ad URL and timestamps for your notes.

Capture takeaways: hook, offer, CTA checklist

Document structure: the opening hook, the promise, the proof, and the call to action. Track run-length across creatives for the same brand. A creative that appears for weeks across regions is a stronger candidate for teardown than a one-off flight.

Revisit the same advertiser later to see rotation changes and recency.

pro_tip: If your brand has multiple domains (.com, country ccTLDs), search each domain separately. The repository groups results by website string, which surfaces regional variants you might otherwise miss.

Faster path: a tool workflow for creatives and landing pages

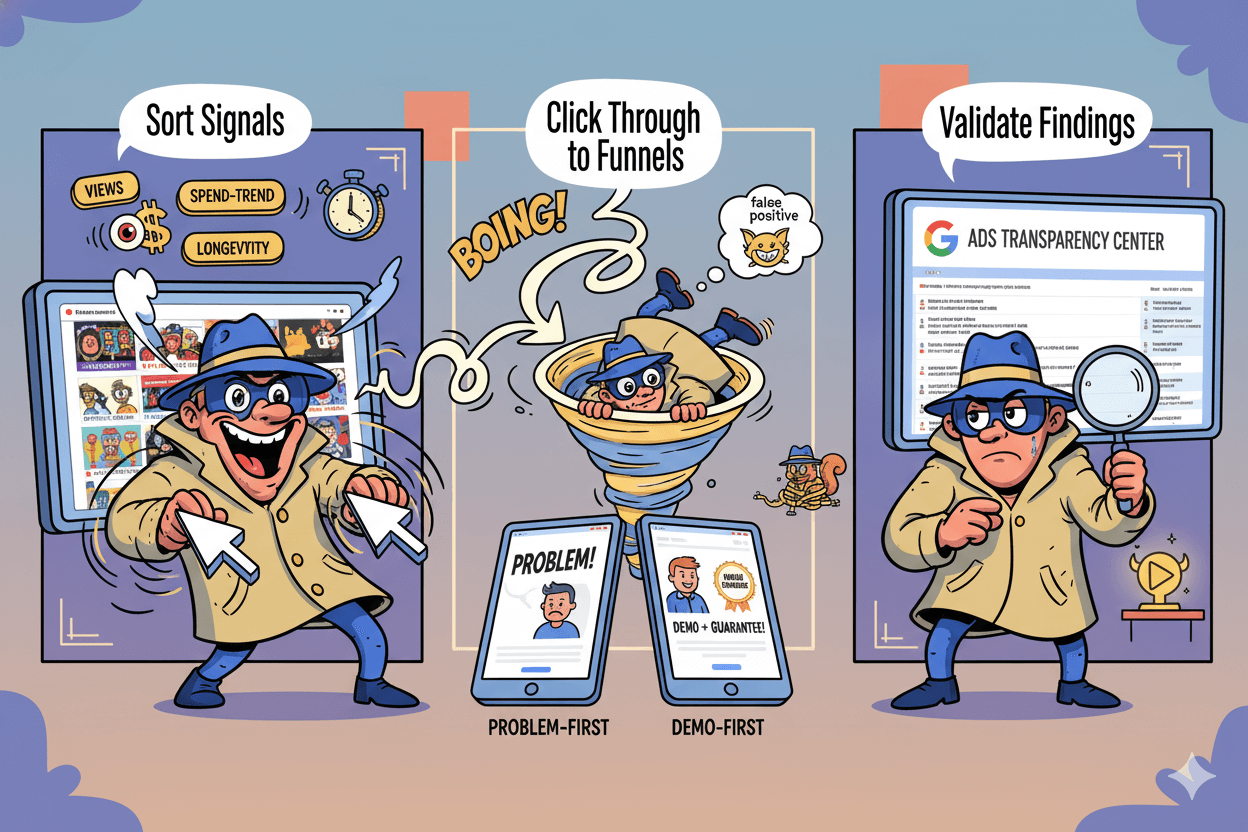

List many YouTube ads at once, then click into landing pages. Sort by views and “spend-trend,” then verify.

Sort signals: views, spend-trend, longevity

Open a YouTube ad-spy dashboard and pull the brand or niche. Use sorting to surface likely winners. “Views” reveals reach. “Spend-trend” suggests ongoing investment.

Filter for newest or longest running to separate tests from staples. These controls exist on commercial tools and are designed for quick triage. Track continuity across weeks to spot durable angles.

Click through to funnels and capture landing-page angles.

Follow the ad record to its destination. Some platforms log the landing page and changes over time so you can see the headline, proof blocks, offer, and form without manual bookmarking.

Use these captures to compare angles and build a swipe file by theme (problem-first vs. demo-first, guarantee placement, social proof density). – Panoramata

For campaigns that drive to multiple variants, note which page persists.

Persistence plus ad recency signals a likely control.

Validate findings in Google’s portal

Treat vendor dashboards as leads. Validation belongs in Google’s Ads Transparency Center. Search the advertiser or website. Filter by location and date. Open the Video results to confirm the creative existed and view disclosures.

This step reduces false positives and keeps your teardown defensible to stakeholders. – Ads Transparency Center

If the tool shows a creative that you cannot corroborate, downgrade it or replace it.

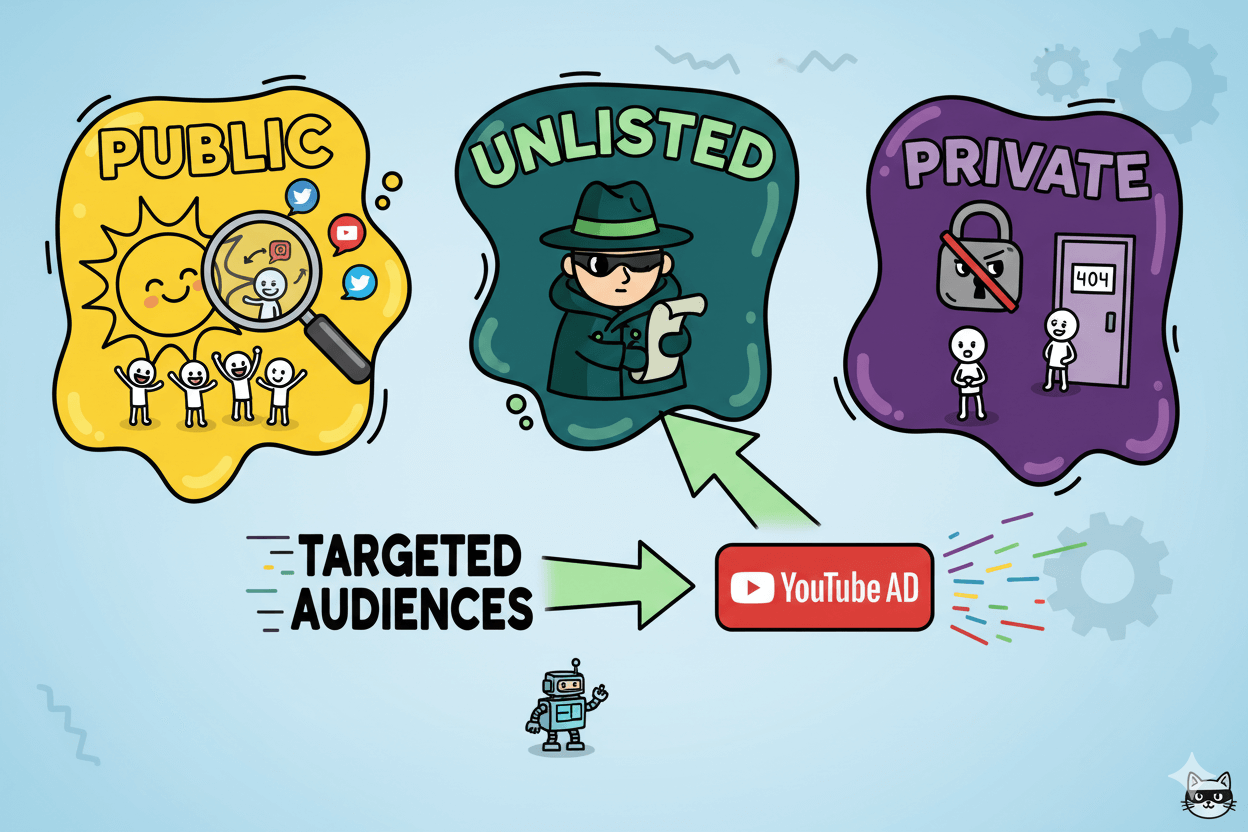

Unlisted ads and what you can realistically see

Many ads use unlisted videos. Treat tool hits as leads and confirm in Google’s portal.

A 2021 security change reset older unlisted videos (uploaded before January 1, 2017) to Private unless creators opted out. That history explains why some legacy ad links you find via tools or old posts now fail.

Recent uploads are unaffected, but you should expect occasional dead links when analyzing archived campaigns.

Third-party libraries claim coverage of unlisted ad creatives at scale. Examples include “tens of thousands” of unlisted ads indexed by KeywordSearch and “14M+ unlisted” inside VidTao’s database.

Treat these claims as discovery aids rather than ground truth. Use them to generate leads, then corroborate with Google’s official repository.

Your verification step is simple. Open the Ads Transparency Center, search the advertiser or website, then filter by Video, Targeted location, and Date.

Open any matching ad card to confirm the creative existed and view disclosures tied to verified identity. This keeps your teardown defensible and catches stale or misattributed items from vendor indexes.

do’s_and_don’ts

Do: use public repositories and authorized vendor dashboards; date-stamp every capture. Don’t: bypass access controls or claim precision on spend/targeting you can’t verify in official interfaces. For landing pages, prefer tools that log destination URLs and change history, then save evidence with timestamps.

Unlisted 101 and ad delivery basics

Unlisted means the video is viewable by link and can be served in ads; it is not indexed on channel pages or standard search.

Creators can switch privacy states; private videos won’t play for viewers without explicit access, which is why some ad links 404 after privacy changes.

Validate unlisted creatives against the advertiser profile

When a tool surfaces an unlisted ad, confirm advertiser presence and timing in Google’s Ads Transparency Center. Search by advertiser or website and apply region/date filters to match your market view.

Use the ad card’s details as your canonical record.

Save links and note angles for teardown

Choose a tool that records landing pages and their revisions. Capture the headline, proof blocks, offer, and form. Pair those snapshots with Transparency Center run windows to infer persistence—a useful proxy when spend data isn’t exposed.

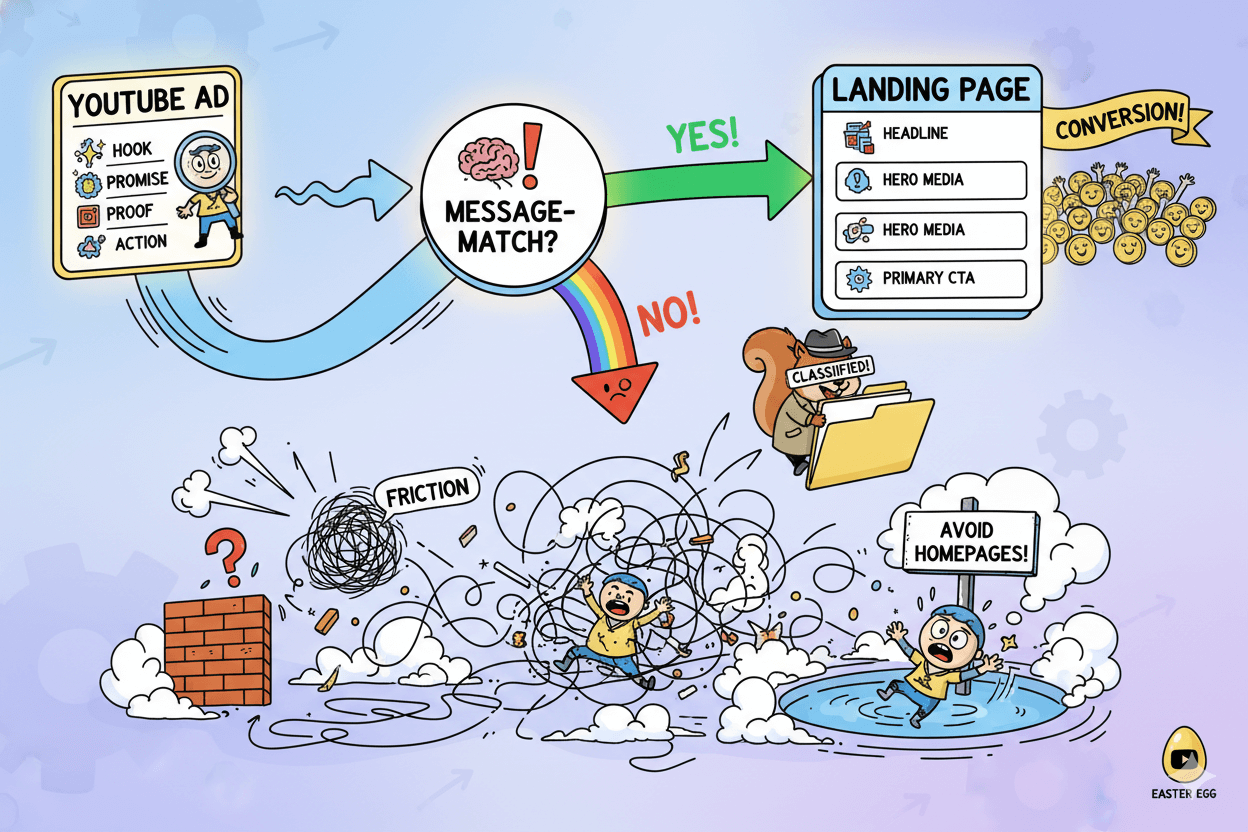

Teardown checklist: from creative to landing page

Message-match or move on: hook, promise, proof, action—then the page must pay it off.

Use a simple lens: hook → promise → proof → action. The ad sets the expectation; the landing page must immediately pay it off. Research-backed heuristics favor clear value, reduced friction, and a single most-wanted action.

Avoid homepages. Send to a focused page that mirrors the ad’s message and CTA.

Creative signals that predict staying power

Catalog the opening 3–5 seconds, the core promise, and any social proof or demo moment. Ads that keep running often show consistent message-match with their page and a clear action path.

Track how frequently the same creative appears across weeks; continuity is a practical proxy for performance when spend is opaque. Validate existence and dates in Google’s Ads Transparency Center.

Landing-page layout patterns to copy ethically

On the destination, confirm immediate relevance: headline restates the ad’s value, subhead clarifies who it’s for, hero media demonstrates the product, and a primary CTA is visible without scroll.

Add trust signals near the CTA (logos, reviews, numbers) and keep forms short to reduce friction. Use a structured checklist to spot clarity, incentives, friction points, and action cues.

Build your swipe file and tag themes

Store side-by-side captures of the ad and page with time stamps. Tools that monitor landing pages can record versions and connect them to the ads driving traffic, which speeds comparisons across offers and niches.

Tag each example by hook type (problem-first, demo-first, guarantee), proof type (testimonial, stat, logo bar), and CTA strength, then rank by how long that ad-page pair remains in market.

Micro-challenge: Pick one competitor. Capture one ad and its landing page today, then again in 7 and 14 days. If both stay unchanged, add it to your “control candidates” list for a deeper teardown and potential modeling.

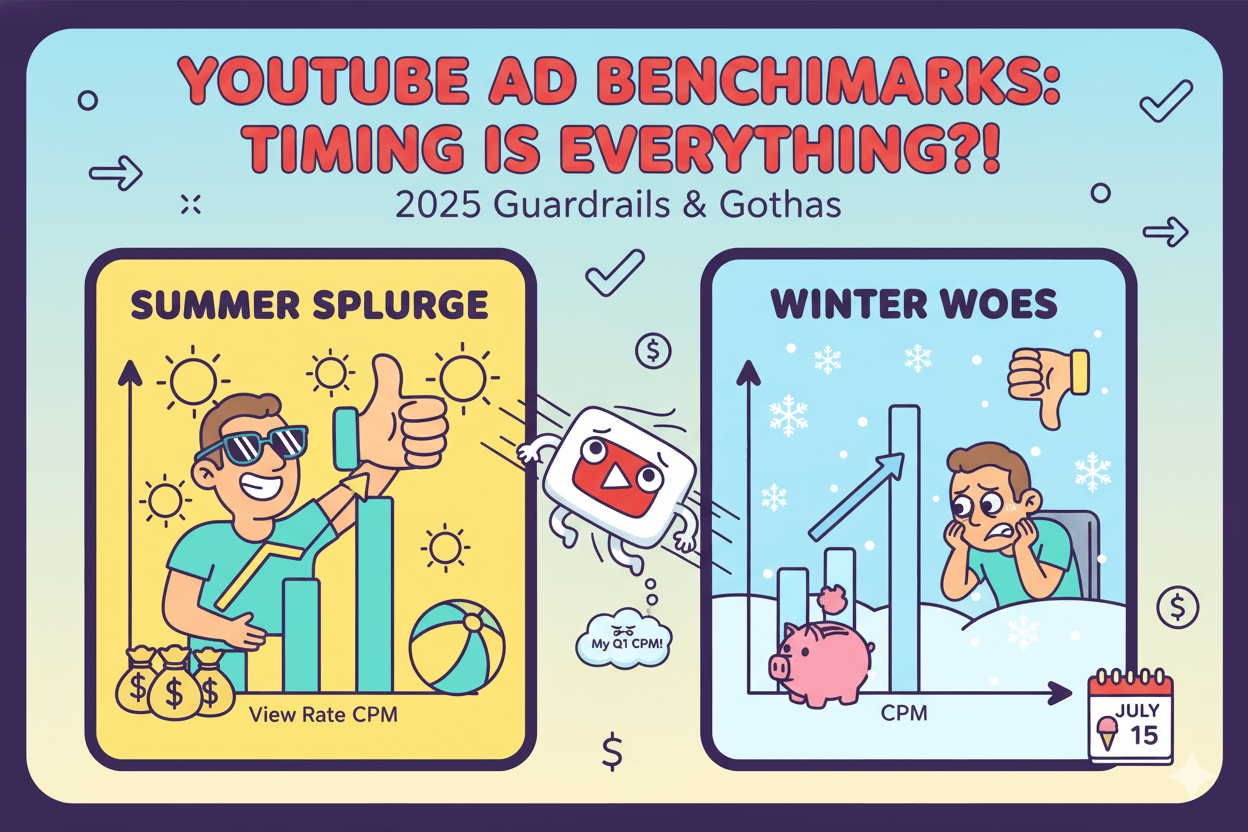

Guardrails: 2025 YouTube ad benchmarks to sanity-check ideas

Plan with dated ranges for view rate, CPV, CTR, and CPM. Benchmarks guide, not guarantee.

CPV and view-rate ranges with sources

Recent roundups put average view rate ≈31.9% and CPV ≈$0.026 across mixed formats. These compilations attribute view-rate figures to recurring industry datasets and define view rate as views divided by impressions.

Use these values to flag outliers, not to declare winners.

Quarterly analyses show seasonality: CPMs tend to rise in Q1, normalize in Q2, and fluctuate in Q3, with view rates peaking midsummer.

Those shifts can make identical creatives look better or worse purely due to timing. Align tests with these cycles when possible.

CTR and CPM ranges with sources

Aggregated 2025 numbers cite CTR ≈0.65% and CPM ≈$3.53 as broad baselines for YouTube ads, with CPC ≈$0.49 where click pricing applies.

Expect variance by industry and objective; awareness formats typically trade higher view rates for lower CTRs.

If you need industry cuts, use per-vertical tables that break out CTR, CPV, CPM, and CVR by niche and ad format to set more realistic thresholds.

How to use ranges to vet ideas

- Date-stamp every stat you reference. Favor quarterly reports for recency.

- Normalize by format (skippable, non-skippable, bumper, Demand Gen). Mixed-format averages hide variance.

- Adjust for seasonality before calling a creative winner or loser.

- Anchor to your niche using industry tables, not all-industry medians.

- Triangulate with another dataset when stakes are high. Large-scale studies summarizing billions in spend help cross-check your plan.

FAQs where smart people like YOU keep asking

Quick answers you can act on: free method, tool method, and 2025 ranges.

Free method answers (portal)

How do I see all ads a brand runs on YouTube?

Open the Ads Transparency Center. Search by advertiser or website, filter by targeted location and date, and select Video to isolate YouTube placements. Open any card for creative, served dates, and disclosures tied to verified identity.

Can I search YouTube ads by keyword?

No. The repository is searchable by advertiser or website, with filters for date and location, not by ad copy keywords. Plan your lookups around brand names and domains.

How current is the data?

The portal exposes served ads over a chosen period and supports country filtering. Treat it as authoritative for existence and disclosures, then cross-check with your market’s region setting.

quick_win: If a brand uses multiple domains, run each suffix (.com, .co.uk, .ca) to surface regional variants. Third-party guides demonstrate separate listings by TLD.

Tool method answers (features + validation)

Are ad spy tools accurate?

Tools index large volumes and add speed features like views and spend-trend sorting. Coverage varies by vendor and niche. Use them to discover candidates, then confirm the creative’s existence and timing in Google’s portal before modeling it.

How do I find a YouTube ad’s landing page?

Use a platform that captures destination URLs and monitors page changes. Panoramata records landing pages and links ads sending traffic to them, which helps you track message match over time.

What signals should I sort by first?

Sort by views, spend-trend, newest, and longest running to separate tests from staples. Persistent creatives plus stable landing pages merit deeper teardown. Validate in the Ads Transparency Center.

Benchmark answers with dates

What is a good CPV on YouTube?

Aggregated 2025 ranges cluster near $0.026 CPV. Treat this as orientation. Check current quarter reports before setting targets.

What is a typical YouTube CTR and view rate?

2025 summaries report ~0.65% CTR and ~31.9% view rate across mixed formats. Expect variation by industry and ad type. Use dated, per-vertical tables when available.

What changed in video metrics naming?

As of October 2025 Google refers to the Views metric as TrueView views in Google Ads reporting. Plan terminology accordingly when comparing sources.

Ethics, policies, and disclosures

Use public sources, follow Google Ads policies, and disclose affiliate links clearly and conspicuously.

What’s permitted in ad research

Google’s Ads Transparency Center is a public, searchable repository of advertisers and the ads they served on Google surfaces, including YouTube.

You may look up an advertiser or website, apply date and location filters, and open ad cards that show creative, served dates, and disclosures tied to verified identity. Use it as your canonical record rather than scraped archives [1][2].

Disclosures and affiliate links

If you earn commissions from tool recommendations, the FTC requires clear and conspicuous disclosures that are close to the endorsement, in plain language, and unavoidable on mobile and desktop.

A footer link alone is not enough. The 2023 revision to the Endorsement Guides re-emphasizes “material connection” disclosures for blogs and social content. – FTC Endorsement Guides FAQ

Regional policy notes and sensitive categories

Policy scope and visibility can vary by region and category. Political advertising has additional verification, disclosure, and targeting restrictions, and platforms may restrict or pause political ads in the EU under new rules.

When researching or citing political creatives, check the Political Advertising section and set the repository’s region so your view matches local policy.

Avoid guidance on political targeting; limit to transparency facts and links to official policies.

Conclusion

You can reverse-engineer YouTube ads without guesswork. Start in Google’s Ads Transparency Center to confirm a brand’s creatives, run windows, and disclosures. Search by advertiser or website, set country and date, then open Video results.

That establishes a defensible baseline and keeps claims tied to verified identity. Next, add a tool to accelerate discovery: scan many brands at once, sort by engagement proxies, and capture landing pages for side-by-side teardowns.

Always validate standouts back in Google’s portal before you model them. Benchmarks guide expectations, not outcomes, so date every stat and check the latest quarterly reports when judging CPV, CTR, view rate, and CPM.

Seasonality and format mix move the numbers. Build a lightweight habit loop: capture → verify → tag patterns → revisit in 7–14 days. Prioritize creatives that persist and pages that stay congruent with the ad’s promise.

Disclose any affiliate links and stay within published policies. When you operate this way, you trade hunches for evidence and turn competitor research into a repeatable workflow that protects budgets and speeds iteration.

Keyword Search: Turn Data Into Sales